After an impressive turnout for the Sydney Resources Round-Up recently, it was evident that critical minerals were a hot topic. One particular presentation that was an absolute standout was from Chris Stevens, CEO of Coda Minerals Ltd. As a jazz musician turned Copper CEO, he was able to execute the importance of Copper-Cobalt exploration in South Australia with the most perfect cadence. It was clear that music led to his highly numerate and quantitative approach in directing such an important project – The Elizabeth Creek Project to be exact.

Equally as important was his emphasis on Environmental, Social and Governance (ESG) Reporting through the globally impactful software, Socialsuite. This system makes it easy to measure, monitor and report on how a mining company’s activities affect the community and the environment. Socialsuite has also been implemented in many other organisations across a broad range of industries including agriculture, biopharma, and technology. We at PX4 look up to other software companies that help the mining and metals industry stay on top of their compliance reporting game.

However, there is still a massive investment requirement to meet critical minerals demand as stated by PX4’s Director, Bill Haylock. With governments controlling the levers of power to accelerate the speed of supply, we need to make a stand to ensure exploration companies like Coda Minerals Ltd. are supported.

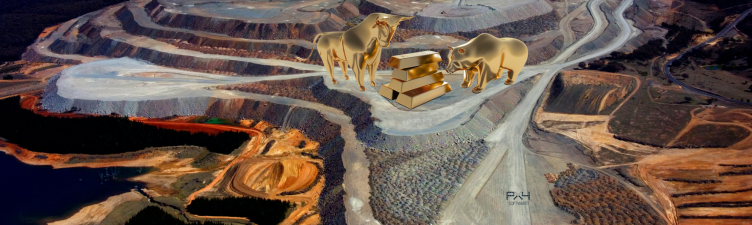

BHP’s Head, Mike Henry stated that governments must also maintain stable fiscal settings, otherwise investment risk increases. This is where reviving the Gold Standard comes into play.

During the first market crash of the COVID-19 pandemic during the first quarter of 2020, gold proved resilient compared to equities which were sold off across the board. Investors saw this ever-present commodity as a safe haven during market volatility due to its protective properties.

This may sound as if it was taken straight from the ASX, and you’d be right. What is a little unclear though is why central banks – who offer banking services to the government – buy gold during uncertain times. A deeper look at its trends over the last four years reveal a strong, stable positive incline when compared to the ASX200 Index Total Return (Bloomberg, 2023).

Therefore, the reason we literally need to revive the Gold Standard again is because companies also mine this precious metal, which is then used for highly efficient electrical conductivity in circuits. In turn, these circuits go into technology products that software like Socialsuite and PX4 are built upon. And software systems like these ensure junior exploration and production companies remain compliant. Finally, physical gold acts as a hedge in investment portfolios which means more business for miners and refiners.

So let’s revive the Gold Standard and our beautiful industry again. The Australian Government; we’re looking at you for help.